There are definitely signs of oil at least trying to decouple from stocks, as I said it might in this week’s newsletter, but if equities really plummet again, crude will probably follow, at least to some extent. So, it makes sense to look at stocks before anything else at the moment…

Stocks

And the fun continues!

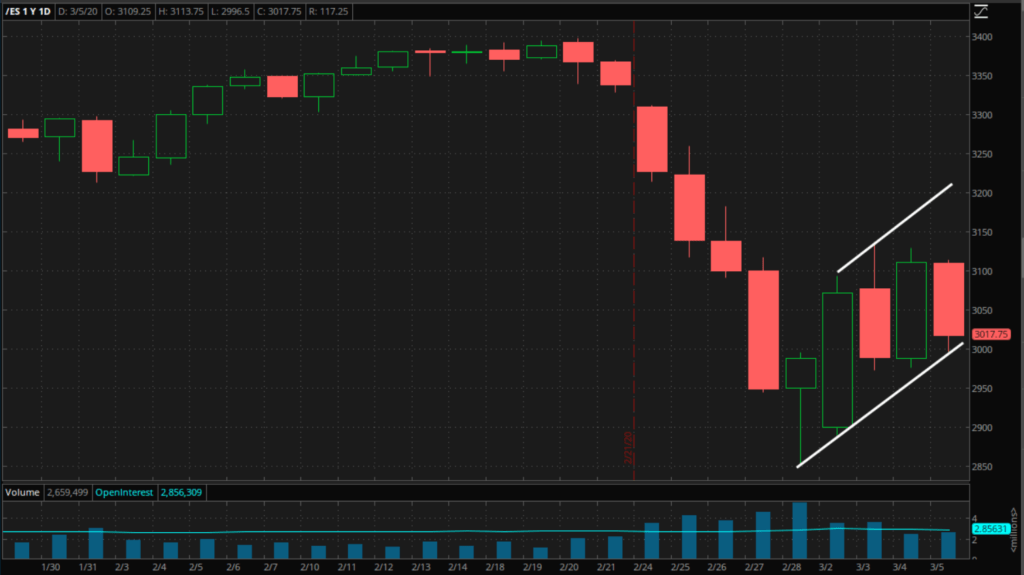

A quick look at the chart for the Dow or S&P makes it clear that the stock market is still incredibly volatile. As I write this on Thursday evening, though, there are signs that we may settle down a bit.

Looking at the chart above, you can see that over the last four days, the S&P 500 has settled into a bit of a rhythm, down one day and up the next. In addition, over the last five trading days, it has achieved higher highs and higher lows, forming a bullish looking upward channel.

If we break lower on Friday, that will all be for nothing and the next logical move would be another test of the lows. If, however, we trade up or even flat to end the week, it will send a pretty strong buy signal.

Keep in mind that everything right now is subject to headline risk, so any stock positions that you might take should be guarded by fairly tight stops.

OPEC+ and Crude

The agreement to cut output discussed in the newsletter also came to pass, but oil’s reaction to that news was more of a jeer than a cheer. When the news broke, crude tried to rally, but quickly gave up those gains and close Thursday down on the day.

These cuts were a well-signaled move, so some degree of “buy the rumor, sell the fact” was likely but even so, Thursday’s price action is a bearish sign. That is especially so when you look at the risks going forward.

The cuts are subject to Russian approval. That shouldn’t be too much of an issue, but that generally held view is where the risk lies. The fly in the ointment may be that Vladimir Putin plays a very long game, and if he perceives a weak oil market and crashing stocks to be doing more damage to Europe and the U.S. than it is to him, then causing another collapse by refusing to ratify the cuts may look worth the short-term pain.

I don’t necessarily believe that will happen, but from here, trading crude becomes about the risk/reward ratio. If the Russians don’t go along with the decision, the selloff will be dramatic. If they do, traders will say “We knew that was going to happen”, so a substantial rally is unlikely. There isn’t a lot of upside left, and a lot of downside.

That would make me favor short crude positions for a while.

Suggested Trade Update

Obviously, that goes against what I said just a couple of days ago, but what can I say? This is a fastmoving market and volatility doesn’t allow for consistent, stagnant views. Every day has to be evaluated separately, and right now long crude looks just too risky.

That said, the hedged trade of short stocks, long crude that I talked about earlier in the week has actually done okay so far. The Dow lost close to 4% today, while crude lost only just over 2%. The hedge was insurance and you would have paid the premium but overall, the position is still in profit.

Going forward then, I would cut the long crude part of the trade and adjust the stop on the short equities to guard against a reversal there.

Looking Forward

By the time I write next week, we should have some idea as to Russia’s response, so I will go into more detail then as to the effect of the OPEC+ announcement.

I am also starting to look at an oil trade that would involve going short to set up a long position in the future. If things stay the way they are, I’ll talk about that too next week. Don’t hold your breath though. A lot can change between now and then and whatever I do write will be based on what is, not what I thought would be.

In the meantime, have a great weekend!

Cheers,

M