Wow, this is a fast-moving market!

Late on Thursday, I wrote the Weekend Market Update E-mail and sent it to the editors. By the time they sent it out this morning, it will have seemed a bit dated.

The main thrust of that analysis, that the assumption that Russia would go along with the OPEC agreed production cuts was flawed, turned out to be spot on. This morning, there are reports that top officials are letting it be known they won’t.

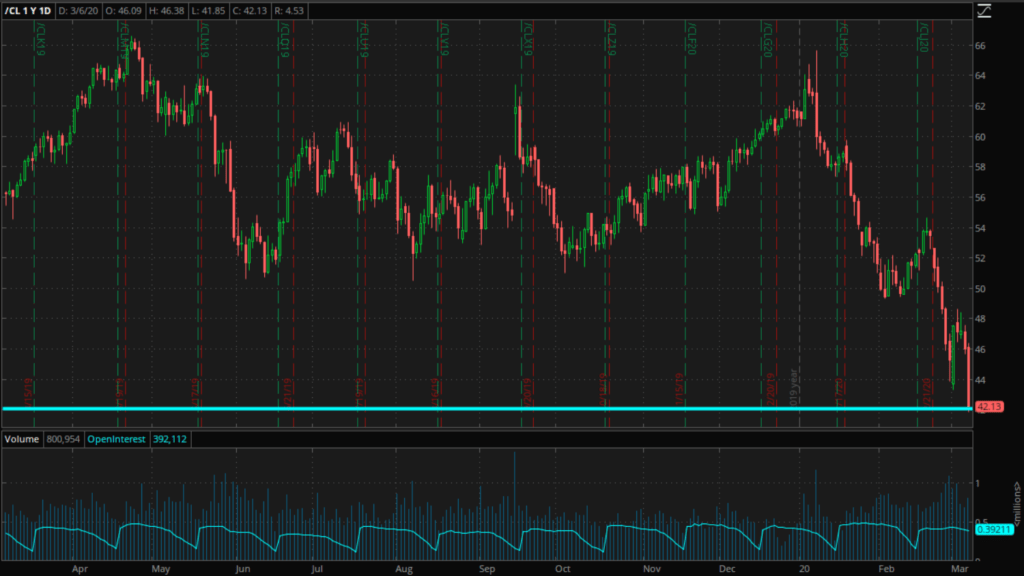

As a result, something else I said in the e-mail is also dated. I suggested a possible “sell to buy” strategy, but that was based around a drop in WTI to the long-term support at around $42. We got there in a hurry though…

So, if you aren’t averse to risk, and assuming that CL hasn’t already smashed through the level by the time you are reading this, a small long WTI position of some kind, with a stop around $41 could be worth a try…

Cheers,

M