This newsletter is called “Deep Earth Publishing”, and I try to stay focused on that most of the time. Right now, though, it looks like the oil markets are taking their key from stocks, so to get a handle on oil, you have to look at the volatility in the stock market and decide what to expect from here.

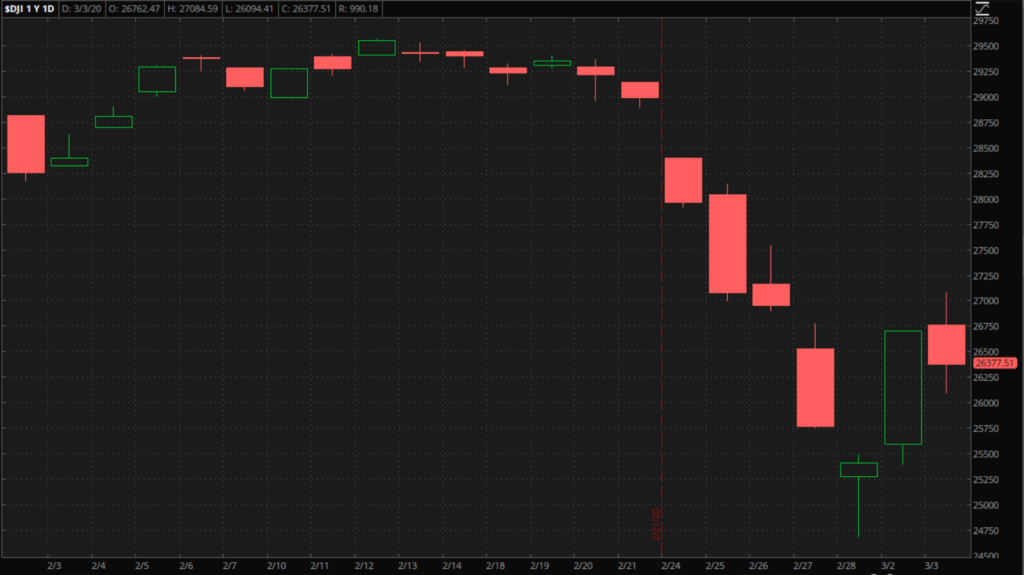

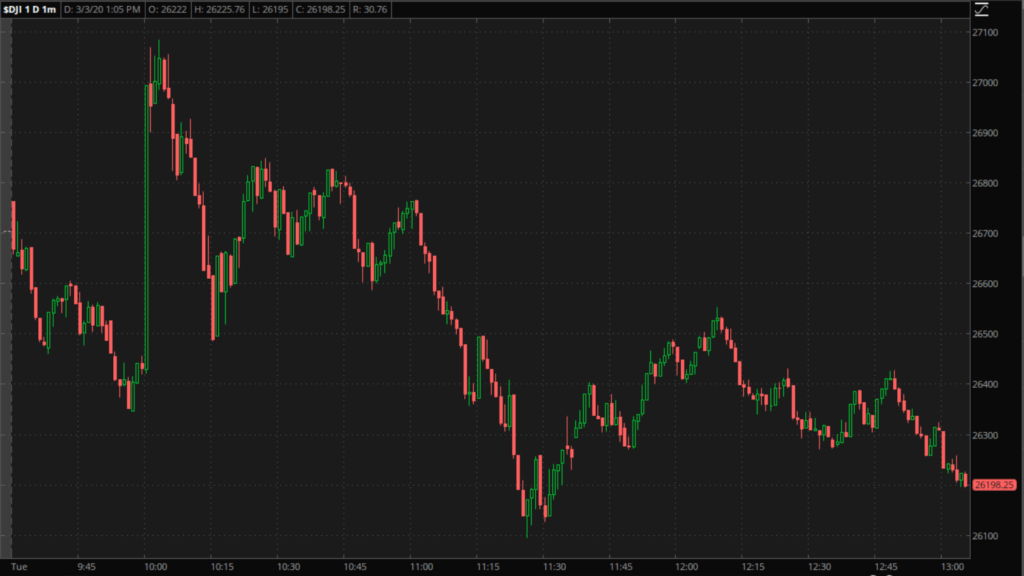

Doing that, it seems that “March Madness” doesn’t just refer to basketball. As I write, we are about half-way through the second trading day of the month, and so far in March, the Dow has seen a nearly two-thousand point move up, then a retracement of nearly a thousand points from the high…all in a day and a half!

That feels like madness to me.

I don’t normally dismiss the value of my feelings about the market, but at times of extreme volatility, it is important to detach yourself from feelings and emotions as much as possible and engage in some rational analysis.

If you do that now, it looks like it is still too early to trust the bounce in stocks.

The Fundamentals

As I said last week, while the talking heads keep telling you this is all about coronavirus, that just doesn’t add up.

First and foremost, we have seen this movie before. H1N1, Ebola, SARS, MERS, Zika…There is a long list of viruses (or should that be virii?) that have been hailed as the big one and engendered a negative market reaction, before being contained, then quickly forgotten. It is quite possible that this will turn out to be more serious, but after five cries of “Wolf!”, more if you include avian flu and a few others, I think a little skepticism is justified.

On that basis, if you believe that this is all about coronavirus and coronavirus alone it would be logical to trust this recovery and grab what you can with both hands.

It isn’t.

The high valuations by the end of February played a part in exaggerating the drop, but it is the political situation, with Bernie Sanders taking an early lead in the Democratic primary race, that really seems to have spooked traders. The last day and a half of price action completely supports that view.

The rally yesterday came after the preceding weekend saw the first coronavirus related death in the U.S., along with a couple of clusters of infection that don’t seem to be related to international travel. If coronavirus was driving the losses, wouldn’t we therefore have lost more ground following that kind of news?

Well, we didn’t. Instead we had the largest single day rise in the Dow in point terms on Monday. So, what else happened over the weekend?

The South Carolina primary.

Joe Biden’s resounding victory there reminded everybody that he was, until recently, dominating the polls for this race. It also pushed out a couple of other contenders who then endorsed Biden. The moderate Democratic vote is consolidating, and that makes it much less likely that Sanders will emerge from the convention with the nomination.

Whatever you think of that politically, the market heaved a sigh of relief.

There was one other aspect to the selloff that didn’t get the attention it deserved, although to be fair, Rick Santelli did make the case quite forcefully on CNBC. This was the stock market throwing a hissy fit.

Traders had decided that they needed more, even cheaper money, and that the Fed should give it to them, and give it to them now! On Tuesday, they got their wish, but then, like spoiled children often do, they refused to acknowledge what they were given and just demanded more. Stock jumped initially on the news of a 50-basis point (half percent) cut in interest rates, but quickly gave up those gains and more.

From a fundamental perspective then, nothing much has changed with stocks.

By the time you read this, Super Tuesday results will be in and we will have a clearer picture of the state of play in the primary. That will probably decide the direction of the market on Wednesday, but longer-term, the uncertainty around the election, along with the uncertainty about the effects of coronavirus, will continue to weigh.

Without another big improvement in Biden’s prospects, we could go lower again.

The Technical Picture

Just as with fundamental analysis, technical analysis of volatile markets is best done after taking a step back. Short-term supports and resistance levels, however you arrive at them, are just about useless when panic reigns.

At times like this, you are looking for broad themes to determine direction rather than specific levels to act on.

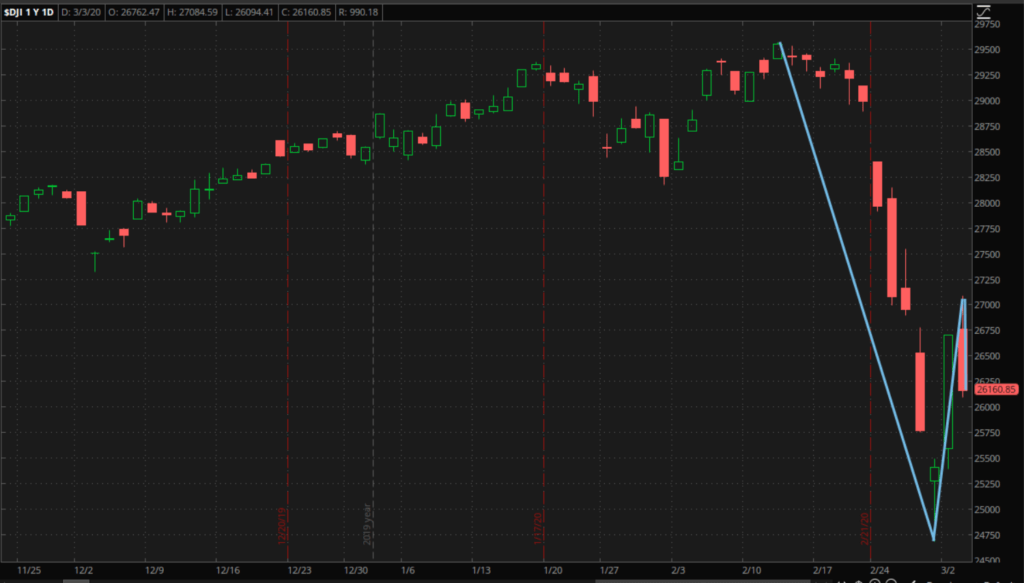

If you do that with a chart for the Dow, using basic Elliott Wave analysis, it looks like this…

If the reversal that started today continues below the previous low, then we are in the third wave of a bearish pattern, with a small correction then another big downward move to come as waves four and five.

That is another reason not to trust the bounce too much.

The thing is, markets rarely move in a straight line, so a retracement of some kind on such a massive drop was inevitable. Given the level of volatility it was also inevitable that it would be large, but the fact that it stopped dead at a fifty percent retracement of the move marks it as probably a temporary phenomenon.

Implications for Oil

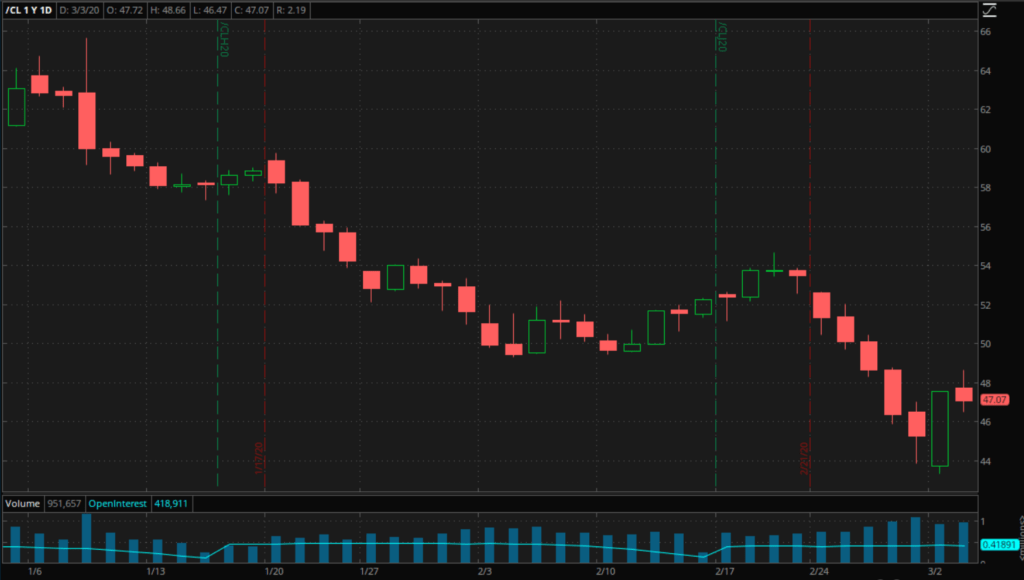

The oil markets have been following stocks down on this move, but that direct relationship seems to be breaking, and for good reason.

Tuesday’s retracement of the Monday gains in WTI futures (CL) is nowhere near as large as that in stocks (which has gathered pace as I write this, now suggesting nearly all of Monday’s stock gains will be erased). That makes sense given the market specific influence on oil.

There is widespread expectation that the OPEC+ group will extend the output cuts soon. Should that be announced, there is a chance of the same “buy the rumor” sell the fact pattern that we saw in stocks following the rate cut, but if so, it will be short-lived. Deeper output cuts will have a lasting effect on oil prices, and that won’t be lost on oil traders, who tend to be more future oriented than their stock market counterparts.

Conclusions

The fact that stocks have tried to recover and failed spectacularly, as well as the unchanged underlying fundamental concerns, makes another push lower look likely in the short-term, even if I’m right and coronavirus is nowhere near as bad over time as the headlines suggest.

Oil, on the other hand, is focused more on the possible positive effects of an extension to output cuts.

This all sets up for a hedged bet on further declines in stocks.

If you take a position that would benefit from further stock market declines, you could hedge it by one that leaves you long oil.

To me that is a good hedge. If stocks do head lower, oil will either head lower too, but at a slower pace, or it will gain despite what stocks do. In the first scenario, you make a bit less than you would without the hedge, in the second, both positions make money. If stocks recover, oil will probably gain even faster, leaving you flat at worst.

There is always a chance that both move against you, but that looks like the most unlikely result of all.

The three most likely of four possible outcomes all result in a profit or flat, so short stocks, long oil looks like a good short-term strategy at this point.

Cheers,

M