Over the last couple of weeks, I have made the point that the whole coronavirus thing is being massively overblown by the markets. It is not that it isn’t an ongoing negative for the stock market and oil futures, it’s just that in a few months’ time it is far more likely that it will have gone the way of SARS, MERS, Ebola and Zika and be forgotten than that it will still be dominating the headlines.

“Nothing to Fear but Fear Itself”

This is one of those situations where it seems appropriate to quote FDR. When it comes to coronavirus, there is, in market terms, “…nothing to fear but fear itself.”

The problem, of course, is that fear is a powerful thing, certainly more powerful than logic.

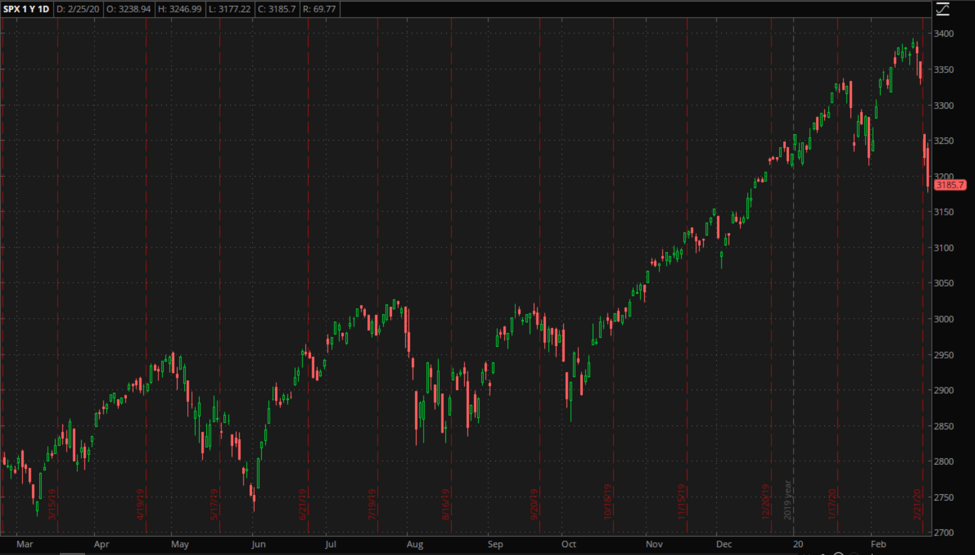

We saw that on Monday, when the Dow Jones dropped the most points of any day in its history, and oil gave back a week of solid gains in one day. Just as an aside, it is worth noting that while the Dow’s losses were the most ever numerically, the percentage decline wasn’t that much and didn’t even break into the top 50. “Dow down nearly a thousand” sounds scary to those of us who remember when the index was much lower, but it really isn’t that big a deal right now.

Still, the fact that stocks gave back their early gains on Tuesday morning so rapidly suggests that there is more selling to come.

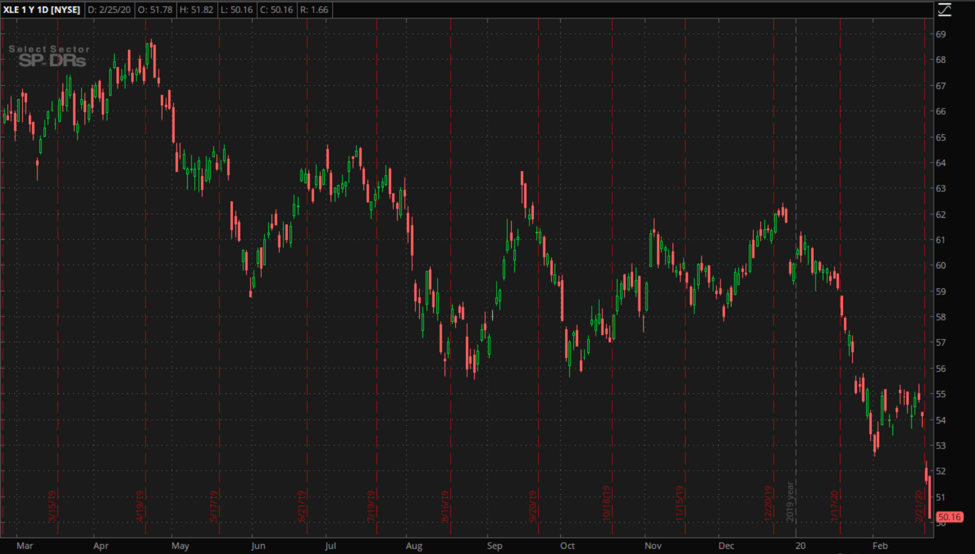

Given what has happened over the last few years, it should come as no surprise that energy stocks are leading the way down. At the time of writing, the energy ETF XLE has lost over 10% over the last couple of trading days, versus around a six percent loss for the S&P 500.

Why Such A Big Drop?

On the surface, the most reported factor, coronavirus, would seem to be the culprit. In a way, that would also explain the bigger drop in energy stocks given the outsized influence of global growth on the sector.

Recent history, though, suggests it doesn’t.

After collapsing early in the year, oil, and therefore energy stocks spent last week bouncing quite substantially, even as the news about coronavirus got worse and worse. That all ended on Monday, despite news over the weekend that the rate of diagnosis in China has plateaued.

The bounce can be put that down to the fact that those involved in the energy market tend to have a longer-term view than most stock traders. They can look ahead to the time when coronavirus is last month’s news and were looking for bargains on weakness.

So, what changed on Monday?

With all the fuss about a disease and all the predictions of a pandemic of biblical proportions, something very important that happened over the weekend, and that could potentially have a much longer-lasting impact on energy stocks got overlooked by a lot of people…

Bernie Sanders easily won the Nevada caucuses in the Democratic primary race.

Who’s Afraid of the Big Bad Bernie?

Before we go any further, let me make one thing clear. My point here is not political in the sense that I favor one party or candidate over the other. I don’t. I generally live by the rule that politics usually comes down to a choice of the lesser of two evils and don’t have any time for partisanship.

Certainly, when it comes to trading and investing, I learned a long time ago to check myself for bias and, if I find any, to leave it at the door of the dealing room. But, if you look at the potential impact of Sanders’ stated policies on energy stocks, hammering them on any hint that he may have a chance to become President is perfectly logical.

His website includes a long, detailed page on how he will implement the “Green New Deal”. Point number two in that policy document, written in big bold, letters says that he will “End the Greed of the Fossil Fuel Industry and Hold them Accountable”.

That involves increasing taxes on fossil fuel companies, doing away with existing subsidies, prosecuting them for perceived past misdeeds, banning fracking and offshore drilling, and a whole host of other measures. Any or all of those things may be justified in response to what is widely seen as an existential threat to the planet, but even the threat of them is going to weigh heavily on energy stocks.

Will He Win?

Unfortunately, I don’t have a crystal ball, so I can’t answer that question with any confidence, but from a trading perspective over the next few weeks, it doesn’t matter. If Bernie keeps doing well in the primary contest and in the accompanying polls, it will make the selling that we have seen over the last two days, in energy and stocks in general, look like just the beginning.

However, given that the Democratic Party establishment is reportedly taking an “ABB” (anyone but Bernie) view of the contest, there is a chance that Sanders doesn’t get the nomination regardless of what happens over the next few weeks. They make take the view that this time is different, and that even pissed of Bernie bros will vote for any Democrat to get Trump out.

That could be right, or it could just open the way for Trump’s second term. Either way, at this point it is far more likely that Sanders is not President this time next year than that he is.

How to Play It

As I said, that doesn’t matter for the next few weeks, or even months, but it does suggest that at some point, buying some beaten down energy stocks will be a good play.

Not yet, though.

At the very least, wait and see what the rest of this week brings. We have seen three trading days of increasing losses, and that is starting to smell like panic. If I am right and this selling is as much to do with fear of Sanders as it is coronavirus, that isn’t going to end soon either.

Still, at some point, the coronavirus part of this will die away, and it is possible that stocks will rebound. Even then though, big oil probably won’t be the best play.

Whoever the Democratic nominee is, he or she will not be talking nice about big oil. Bernie has already set the tone, and while someone like Biden or Buttigieg is never going to embrace the Green New Deal, there will be a lot of talk of incentives to move to renewable energy sources.

That makes it quite possible that even as the market as a whole begins to recover, traditional energy stocks stay depressed. It also means, however, that stocks tied to solar, wind and other renewable sources are likely to outperform. That will be the best way to play the bounce.

Conclusions

Coronavirus is grabbing the headlines as stocks collapse, and that is understandable. Other than those liked me who regard bad risk assessment as a despicable thing, you won’t lose any viewers or readers by making a disease out to be the bogeyman, yet it is still scary enough to drive eyeballs and clicks. It is easily grasped and taps into a fundamental human fear. It is tailor-made for headlines.

Talking about a stock selloff because of the rise of a political candidate, on the other hand, will alienate that candidate’s many supporters and give the impression that traders are using their positions to influence the election. Plus, the primary process is long, uncertain and messy, so doesn’t lend itself to a page-heading six-word or less summary.

The thing is though, the severity and impact of coronavirus doesn’t match the level of selling we are seeing, nor does the timing make sense, coming just as new cases in China are beginning to decline.

That makes it far more likely that, headlines or not, the rise of Sanders is at least as much of a cause of the selling as an Asian centered upper respiratory infection, and if that is the case, there is probably a lot more to come.

For the sake of my IRA and 401K if nothing else, I hope I’m wrong, but for now, a patient approach coupled with some hedging of portfolios and maybe a couple of shorts looks to be the best strategy for investors.

Cheers,

M