Earnings season is a time of great opportunity for any stock trader, but it is also a time of enormous risk. That is especially true these days for those who focus on energy stocks.

Not that long ago, the exact opposite of that was true.

The giant, diversified multinationals, the likes of Exxon Mobil (XOM), Chevron (CVX), and Royal Dutch Shell (RDSA) have always been well covered by analysts and, that combined with what was once the predictability of energy demand and pricing meant that estimates were rarely very far off the mark. Misses and beats of expectations weren’t uncommon, but they were rarely by enough to cause significant volatility in the stocks.

That all changed when the price of oil collapsed in 2014-15. At that time, even the normally cautious big boys in the oil business found themselves overextended with a lot of projects that made perfect sense with crude at $110+ per barrel, but not so much when oil sank to below $40.

After that, as losses were taken and adjustments made, big swings on earnings became commonplace. For traders, that kind of volatility equates to opportunity, but only if you understand earnings and the market’s reactions to them.

Before trading on earnings, you need to understand what they mean.

What Is an Earnings Report?

40 or 45 days after the end of each of the first 3 quarters of its financial year, every publicly listed company is required by law to file a form 10-Q with the SEC, then at the end of their Q4, a 10-K. Those are similar forms that include the corporation’s financial statements and comments from management about the company’s financial condition, market conditions, specific risk factors, and any internal changes and controls.

At the same time as those filings are made public, most companies issue a press release with the most important information. It is that release and subsequent comments that are usually reported by the media.

What to Look For

Usually, the most important number in an earnings report is how much money the company made. That is expressed as Earnings per Share (EPS) and is usually the first number reported in the financial media. The very purpose of a corporation is to make money, so that being the headline number makes sense, but there are others that matter too.

First among those others is revenue or sales.

In some cases, such as when a young company is still growing rapidly and investing heavily in that growth, revenue is actually a more important metric than profit. The classic example of that would be Amazon (AMZN). They went for many years without turning a profit, all the time investing in the infrastructure needed to satisfy growing demand and diversifying into areas like the now enormously profitable Amazon Web Services (AWS).

At that time, nobody cared how much money, if any, they made. The success of their strategy was measured by revenue growth alone. The energy equivalents would be green energy related companies that are rapidly expanding, such as Tesla (TSLA), or maybe a young, dynamic E&P company that is buying up assets while oil is low, and they can be had cheaply.

Everything is Relative

Earnings and revenue both need to be considered in the context of what the company is trying to achieve at any given time, but there is another, more important context to be considered. The stock market is sometimes referred to as a forward discounting mechanism, which is a fancy way of saying that traders and investors try to predict the future. The price of a stock is an indication of what people expect to happen, even more than it is about what happened in the past. Those expectations are usually based on the research done by Wall Street analysts who cover the stock and who give their own forecasts for earnings and revenue.

The consensus view of those forecasts are what earnings releases are judged against. It is quite possible for a corporation’s sales and profits to increase significantly from the last quarter or the same quarter last year, but those “good” results to still be seen as disappointing. If they miss the consensus forecast that is already baked into the price, the stock will drop, regardless of the improvement.

Quarterly results are always judged against expectations.

Energy Specifics

The headline numbers of EPS and revenue are important for energy companies, but there are also frequently a lot of other things contained in the full SEC filings that can change the direction of the stock.

In the market conditions and risks comments, for example, an oil company often reports on the productivity, and even the viability, of various projects. Many also include guidance for the next quarter or year and their assessment of the likely path of commodity prices.

It is important for anyone trading or thinking of trading on energy earnings to understand that the headline information can often be superseded by things buried deeper in the report.

Taking a Position Before an Earnings Release

This is a lot of people’s idea of what trading earnings is about. They see the big moves that often follow a release and try to get in front of them.

That is a mistake.

Trading is inherently risky and long-term success is about managing and controlling that risk to the best of your ability. Taking a position in front of an earnings release severely limits your ability to do that.

Earnings reports are almost always released outside of normal market hours, when the market is thin. That means that a stock can gap in one direction massively immediately after the news breaks, which makes risk management almost impossible.

Let’s say you buy something at 45 just before earnings and set a stop loss order at 44 to limit the potential downside of a trade. That order will be filled at the first available price below that level, but after an earnings miss and in a thin market, that could be a lot lower than 44.

The potential rewards of positioning in front of earnings may be big, but the potential losses are even bigger, and on what is essentially a trade with a 50/50 chance of success that isn’t a position you want to put yourself in.

Far better to wait until the numbers are out. When they are, however…

Don’t Be in Too Much of a Rush to Trade

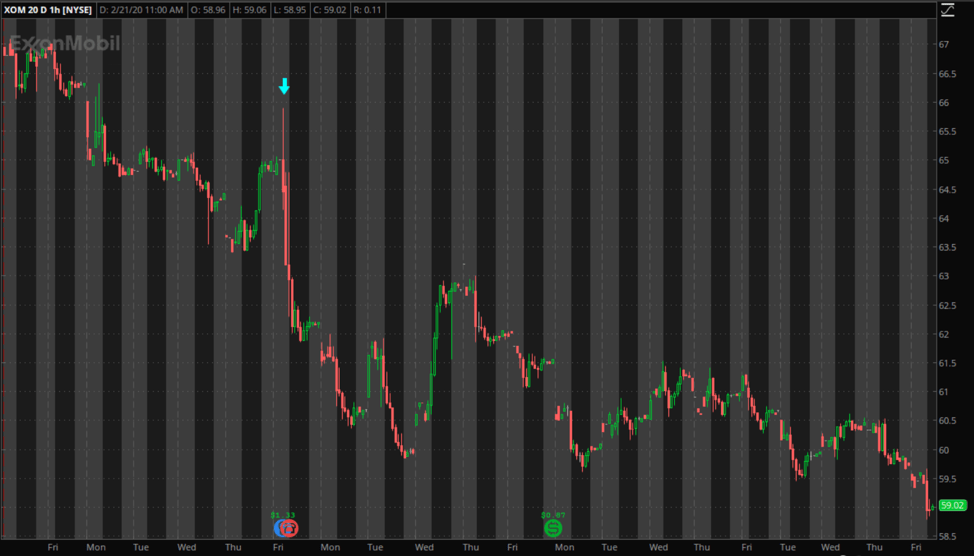

This is a theme that I frequently return to when talking about tactics for independent traders, but it is particularly important in this context. You are never going to act and execute a trade faster than the computers, and attempting to do so can cause some serious problems. As an example, take a look at the 20-Day, 1 Hour chart below for XOM, that covers the release of their Q4 2019 earnings…

The “news” in this case was the headline EPS number, which was initially reported as being $1.33, way above the consensus forecast for around $0.51. That is what caused the initial jump in the stock, marked on the chart by the blue arrow. That, however, was an unadjusted number, and when adjustments for one-time items were made, EPS was actually below estimates. That, and forward guidance that was anything but optimistic, is what caused XOM to reverse quickly.

If you had attempted to trade the news, you could well have reacted to that unadjusted number and found yourself buying just before XOM collapsed. If you waited for the reaction to take shape, however, that mistake would have been avoided.

Tactics and Strategies

There are many ways of classifying trades, but in the context of post-earnings trading, the most useful and significant is momentum versus contrarian. As the words suggest, a momentum trade goes with the flow of a move, while a contrarian trade opposes it.

In many cases, my training and nature make me favor a contrarian approach, but immediately after earnings, particularly for “swing” trade designed for a timeline of weeks rather than minutes or hours, that isn’t usually the case.

Momentum sparked by earnings news can continue for some time. As the numbers are digested, the Wall Street analysts adjust their forecasts for upcoming quarters and the year accordingly and as each of those revisions is reported, the market reacts again, and the move is exaggerated.

The biggest advantage of trading with momentum is that, unless you get really unlucky and hit the absolute end of the move, you will probably be in profit soon after executing the trade. That may not be enough to justify cutting and taking that profit, but it does mean that a stop can be set not too far from your entry point, and that will limit potential losses to a minimum.

Position management is not just about setting a stop loss, however. There is also the question of when to cut for a profit.

For a post-earnings trade based on strong momentum, the best way to handle that is to set a trailing stop loss order. That is an order that will be triggered on a retracement of a set dollar amount or percentage. It enables you to ride the momentum as long as it continues but cut and take a profit when the move reverses.

Conclusions

Trading on earnings releases can be very profitable, particularly in energy right now given the big post-earnings moves we are seeing. To do it successfully though, you have to know what you are doing and, most importantly of all, trade in a style that allows for the increased risk that it entails.

If you understand what to look for in a report, wait for the dust to settle a bit before jumping in, and then employ good position management strategies. When you do, you set yourself up for success and earnings season can quickly become a time you look forward to.

Cheers,

M