If you have been awake at all over the last few weeks, I am sure you have heard of coronavirus. Stories of its spread have been running every day, and it seems that each time any market moves we are told that the Hunan Coronavirus is to blame.

When stocks drop, it is coronavirus. When oil drops, it is coronavirus. When bitcoin climbs, guess what…coronavirus!

I guess it is possible that this latest form of upper respiratory infection will be the big one and lead to the end of civilization as we know it. Possible, but not likely.

It is far more likely that in a couple of months we will have forgotten all about it and this will, with hindsight, be just a storm in a teacup.

That said, there are two priorities for any trader or investor when considering a news-driven move like this.

The first is to profit from it.

The second is to consider what it can teach you.

We addressed the first in last week’s newsletter.

Trade Update

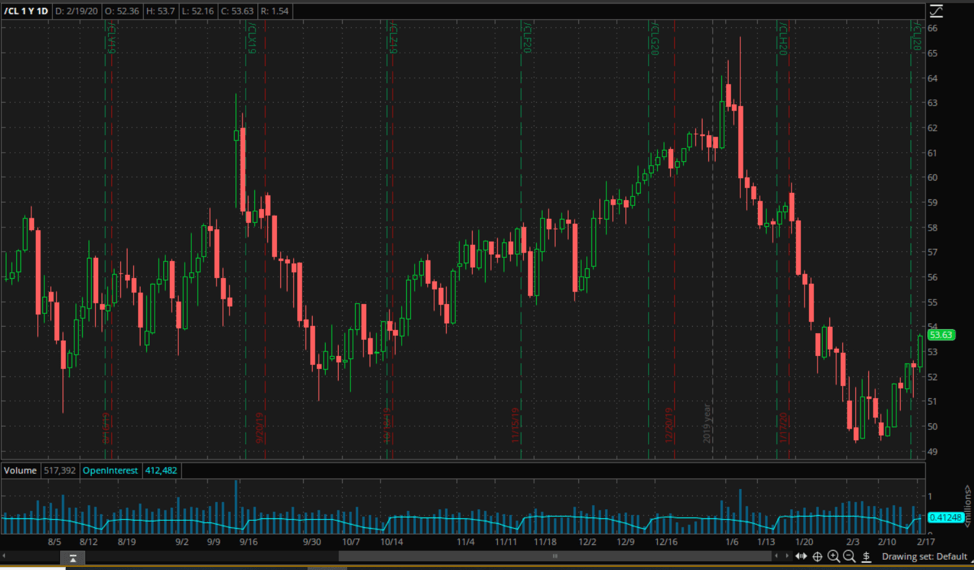

I said then that WTI had formed a tradeable bottom just below the $50 level, and that initiating a long oil position in anticipation of a bounce would be decent trade.

Not to brag, but here’s how the chart for the main WTI futures contract, CL looks now, a week later…

As expected, oil is bouncing.

The idea I outlined was to trade the opportunity using UWT and thanks to the leverage inherent in that ETF, that bounce now amounts to a roughly 12.5% profit in a week.

We haven’t hit the target yet, but if you wanted to bank a profit here, that would be fine. I still think there is further to go, however, for reasons I’ll get into later, so my strategy here would be just to move the GTC stop up to $7.75. That would mean that the trade is now risking only a nominal amount (around 0.5%) and is positioned for great upside…

Doing that puts you close to the perfect position for a trader…what I refer to as a trade to nothing. That is when your potential loss is zero, and your only decision is how much profit you want to take.

It isn’t hard to see why I like that!

Identifying those opportunities and adjusting to leave yourself in that position whenever possible is a major part of successful trading and investing.

The Coronavirus Impact

In large part, that successful trade came from my view that the move down on the coronavirus headlines was hugely overdone.

Oil had lost around fifteen percent in the early days of the disease’s spread. In many ways that makes sense given crude’s sensitivity to fluctuations in global demand, but at those levels an awful lot of bad news was priced in.

What we are seeing now is that even as the actual problem worsens, oil is recovering.

That may or may not continue. WTI could still turn again, either on more bad virus news or something else. Whether it continues higher or not though, there are things we can learn from the price action so far.

The first and most obvious is that markets overreact.

Anybody who has ever worked in a dealing room understands that and knows why it happens. In that environment, traders are hyper-focused on one thing. Inevitably, news that has an effect on that thing takes on exaggerated importance.

In the moment, joining in the move is the only thing to do, even if a calmer head may decide it is past its logical endpoint. Eventually though, those calmer heads do prevail, and we see the kind of bounce that we have seen over the last week.

The second lesson we should learn is…

Trade the Reaction not the News

If you are familiar with my work, you will no doubt have seen me say this before. It is one of the most important pieces of trading advice I can give, and it applies as much to long-term investors as it does short-term traders.

You will often hear people say that the market is stacked against individual traders and investors, and I suppose in some ways that is true. You don’t have the immediate access to information that the denizens of dealing rooms do, nor do you see the big orders that can bring even the strongest move to a grinding halt.

When you try to trade headlines such as those on coronavirus, you run headlong into both those disadvantages.

By the time you trade, the big money has already acted and there is far too big a chance that you will be one of the last ones in, left holding the baby when the market turns.

It is far better to let the move develop, then look for signs of a turnaround, just as I did last week. You cannot know how far the reaction will go, but you do know that at some point, there will be a retracement. Trade that, not the original move.

What Next?

I had intended this week to find a couple of stock plays to take advantage of the bounce, but on reflection that is probably not smart at this point. I have a trade that is making money. Adding to the position by buying individual stocks that will benefit from more of the same risks making exactly the mistake that I tried to avoid in the first place. The momentum now is upward, but the principles are the same.

That brings us to the next lesson…

Don’t overtrade!

One of the things that makes investing such fun is that something is always happening, and markets are always moving. If you are not careful though, that can lead to a constant state of “FOMO” (Fear of Missing Out) that makes you think you should always be doing something.

That isn’t true.

When trading, you should always be aware of the old admonition against not fixing what ain’t broke. As a very wise boss of mine once said, deciding to do nothing is still a trading decision, and it is often the best one you can make.

Conclusions

We can learn a lot from the market reaction to the headlines about coronavirus. It shows us that the market tends to overreact, that it is better to trade the reaction than the news, and that sometimes, doing nothing is the right move.

Look a bit deeper into it though, and it also tells us what to expect from here. The bad news is still coming but oil, and stocks too, are bouncing back already. That suggests that the bounce has further to go, so sit tight on long positions until something changes. We will look again next week.

Cheers,

M