Understandably enough, as oil has collapsed so spectacularly over the last couple of months, it has drawn the attention of a lot of traders and investors. After all, as I often say, movement makes opportunity. There is, however, another energy market that has also been on the move and there are opportunities there too…natural gas.

As you can see from the chart, though, poor old natty’s problems started long before anyone had even heard of Covid-19. In fact, if you go back further than the chart above, the futures contract NG was trading close to $5 at the end of 2018, so the decline could even be traced to then. So, what caused it?

What Caused Natural Gas to Collapse?

In a way, natural gas’s problems are not of its own making. They are largely the result of changes in the oil market.

At the beginning of 2018, when it became clear that the so called OPEC+ agreement between OPEC and a few other select oil-producing countries (most notably Russia) was both beginning to have an effect and going to last some time, oil prices started a long climb.

By October of that year, though, doubts about global growth started to emerge, and that couldn’t have come at a worse time for crude. By then, “Shale Boom 2: The Sequel” had opened in oilfields near you all over North America. The higher price after a year of steady gains and lower supply from the OPEC+ countries made new wells viable, and U.S. output skyrocketed.

With that increased crude production came a massive increase in the domestic supply of natural gas.

Most oil reserves offer a mix of oil and natural gas and, as a general rule, the gas/oil ratio is higher in shale wells than conventional, so as shale oil production increased, so did natural gas. Oversupply became a real problem.

Why Is A Rally on the Cards?

Now, though, with oil demand grinding to a halt around the world as a result of the coronavirus response and WTI nudging $20 a barrel, many of those recently opened oil (and gas) wells are being shuttered.

That is bad news for the energy sector as a whole but may be good news before long for nat gas prices.

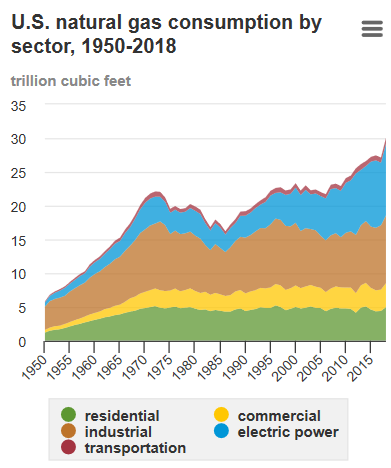

Nat gas demand isn’t comparable to that for oil. The primary use of oil is making gasoline, so as the world’s economies have shut down and driving has stopped, oil demand has been decimated. Over half of total demand for natural gas in the U.S., however, comes from electric power plants and home heating and cooling.

Increases there with everyone staying home should offset reductions elsewhere so, while there may be a small dip in demand, it won’t be that great. Oh, and U.S. total demand has been climbing for years…

You don’t need an economics degree to understand that if supple is significantly reduced and demand just stays pretty constant, prices should rise. Nor am I the only one with that opinion. This article from naturalgasintel.com quotes reports from three different analysts and teams, at Tudor, Pickering, Holt (TPH), Goldman Sachs, and Raymond James, all of whom see higher nat gas prices in the future.

How to Play It

The most obvious strategy here, buying natural gas futures or a leveraged ETF that tracks them, probably isn’t the answer.

There has been a glut of gas for some time in the U.S., leading to very high storage levels. Some drawdown of that will have to come before prices rise, which could make a direct play on price very expensive in the short-term. As the evidence grows of a drawdown though, and especially if prices start to stabilize, stocks with exposure to natural gas, which have been under a lot of pressure, could take off.

Maybe an oil and gas E&P company like EOG Resources (EOG) would be a good idea. Over fifty percent of their production is gas and gas liquids and they have maintained good cash flow and stayed profitable, even as oil and gas prices have dropped.

A more direct play on gas, although a bit less price sensitive, would be Cheniere Energy (LNG). They own and operate some major gas pipelines as well as two large liquefaction plants and export terminals.

They have maintained high margins and good growth for a while and generated over $1.8 billion of operating cash flow over the last year.

The different exposures and influences on price of these two stocks mean that, while both would benefit from a surge in nat gas prices, you can still diversify to some extent by owning both.

As with any trade of course, the key here is timing.

Short-term demand dynamics (more specifically a forecast for a warm but not too hot late spring and early summer) are keeping the pressure on natty for now so I am not in a rush to buy just yet. One of two moves in NG would prompt me to though.

A little bit closer to the support trendline, which currently sits at around 1.5460 would be a buy signal for me. If we turn around before that, I would want to see a break of 1.70 before believing in any rally.

Either way, I will be investing in the nat gas sector before too long. It has been a disappointing place to be for a long time, but things look about to change and when they do, there will be a lot of money to be made.