Energy is a constantly evolving sector. That is part of its appeal, but it is also one of the challenges for investors. To deal with that challenge, it is important sometimes to take a step back. For all the short-term volatility that has characterized energy markets recently, it is the long-term dynamics that will determine the future.

Indeed, much of that short-term movement is a direct result of the long-term state of flux of energy, so understanding those influences is essential, whatever your investing approach and style.

So, here are the big five; the themes that will shape the energy sector over the next five years and beyond.

1: The Rise of Renewables

If you ask people what they regard as the number one long-term influence on energy, I am sure most would cite the rise of alternative renewable sources like solar and wind power. After all, anyone who listens to the news hears all the time that fossil fuel dependency is destroying the world, and that we have to change.

It is a subject that produces some strong opinions. From an investment perspective, however, whether you believe that is all made up, or that it is the biggest threat to mankind ever, or somewhere in between, is irrelevant. You should invest based on what is, not what you think should be.

There are two relevant facts. One is that most governments in the developed world accept that it is true and are mandating cleaner energy production. The other is that despite that, fossil fuels aren’t going away any time soon.

Those things are not mutually exclusive, in large part because of the second long-term influence on energy…

2: Increased Global Energy Demand

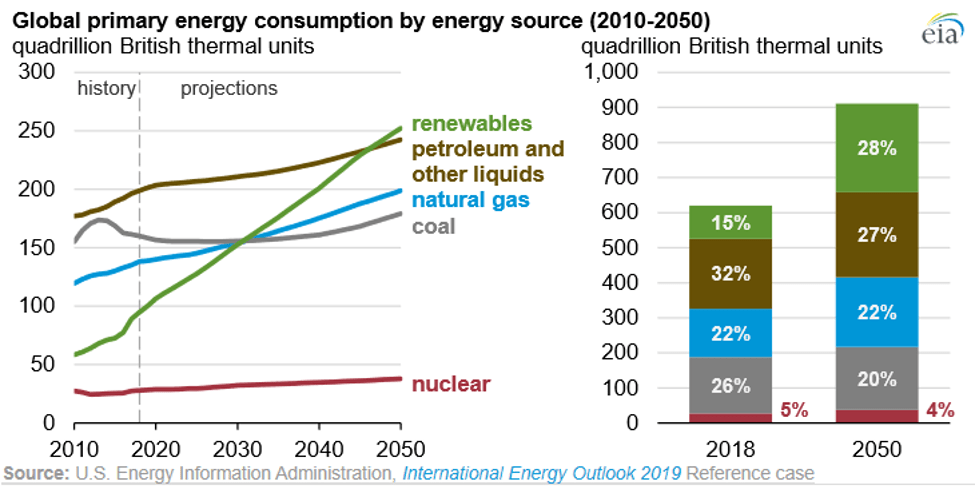

In a September 2019 report, the U.S. Energy Information Administration (EIA) predicted that total global energy consumption will rise by fifty percent over the next thirty years. In the past, such studies have consistently underestimated the growth in energy demand though, and there is no reason to think this time will be any different.

Energy consumption increases with economic growth, but some growth is more influential than others. A marginal increase in wealth in an already wealthy country such as the U.S. has minimal impact, but even a small increase in wealth in a developing country can make a huge difference.

Apart from the basic things like lighting and heating houses that increase demand as people are lifted out of poverty, there are also the peripherals that come with that. Cars, computers, cell phones…almost everything emblematic of economic progress, consumes energy. Six to eight percent growth rates in China and India are therefore far more influential than two percent in Europe or America.

Even if we use the EIA numbers though, global energy demand is expected to rise to such an extent that even a big increase in renewable energy production can’t keep up.

As you can see from the chart above, which comes from that report, while the percentage of global energy from renewables will grow significantly, the demand curves for oil and natural gas also slope upward.

There will be plenty enough demand in the future to make all energy sources profitable.

3: The Rise (and Fall?) of U.S. Shale Production

Again, this is a story that energy investors are familiar with.

Over the last decade or so, rapid increases in mining technology, most importantly in techniques for hydraulic fracturing, or “fracking”, have revolutionized the oil industry in America. Oil reserves that were considered inaccessible not long ago are now easily recoverable.

That has led to a massive increase in crude production in the U.S. So much so in fact that America has shifted from being the world’s largest importer of oil to be a net exporter. There are a lot of implication of that for economic growth and national security, but the implications for oil prices are what should concern investors the most.

The rapid increase in output has put a top on prices. That is not to say that oil hasn’t moved higher at times, but each time over the last few years that it has threatened to surge back towards the $100/barrel mark we saw in 2014 it has quickly turned tail as more wells come on line to take advantage of the high prices.

That has had an impact on the whole sector, as it has kept profits low, even as expanded output has demanded big investment.

At some point though, that will change.

One of the things that has driven the rapid production increase is that fracking has produces a much faster flow of oil than most predicted. However, that also means that wells will become exhausted that much quicker.

We are still a long way away from that being a big influence, but an increased awareness that it is coming will erode the resistance to higher prices gradually over the next five or ten years.

4: OPEC

The very fact that OPEC is number four on the list, not number one, indicates the problem here, for them at least.

I am old enough to remember the oil crises of the 70s and 80s, when the name OPEC could strike fear in the heart. This century though, the power and influence of the cartel has been declining. That is in part due to the increased U.S. output mentioned above, but internal divisions and a lack of compliance with quotas have also been factors.

A couple of years ago, in an attempt to return to their previous power, OPEC negotiated a deal to reduce output with other, non-OPEC interested countries, most notable Russia. That has been fairly successful in propping up oil prices, but can it last?

A lot depends on factor five…

5: The Middle East

Even with the big increase in U.S. supply, the Arab nations in the Middle East still have a massive impact on the oil market and, as I’m sure you are aware, it is not a very stable place.

Strife in the region is nothing new. It has been around for a few millennia now, but over the next few years, shifting alliances could cause a major blow up.

Until recently, the dynamic seemed simple from a Western perspective. The one thing that united the Arab countries in the area was hatred of Israel, and, as a result, tension with Western democracies that supported them.

It has, however, always been more complex than that, and recent events are making that clear.

The real divides in the region date back way beyond the creation of a Jewish state. Hostility between Shia and Sunni Moslems and tribal disputes that predate even the Prophet Mohammed are at the root of the problem. Banding together against Israel suited everyone for a while, but that was never going to last forever.

Recently, Saudi Arabia and other Sunni countries have banded together in some instances, even with Israel, against their common enemy, the Shia dominated Iran. That kind of shift in power dynamics is disruptive, and in the Middle East, disruption is always dangerous.

Any escalation could be massively disruptive to the world’s oil supplies, so the situation must be watched closely.

Conclusions

As these themes play out over the next few years, you can expect volatility in energy commodity prices, and therefore in sector stocks, to continue. Overall, though, the things that keep the sector growing, finite supply, increasing demand and Middle East conflict are still factors.

For investors that means that a diversified portfolio is essential. While short-term adjustments to that portfolio are a good idea, staying invested in energy over the next five years will prove to be a good strategy.

Cheers,

M