Last week, in the original weekend market update, I pointed out that the agreement of Russia to the latest round of cuts negotiated by OPEC was no sure thing. That turned out to be right, but nobody saw what came next.

Saudi Arabia, in what looks like a fit of pique, immediately piled the pressure on by slashing prices and announcing a boost to their own crude output.

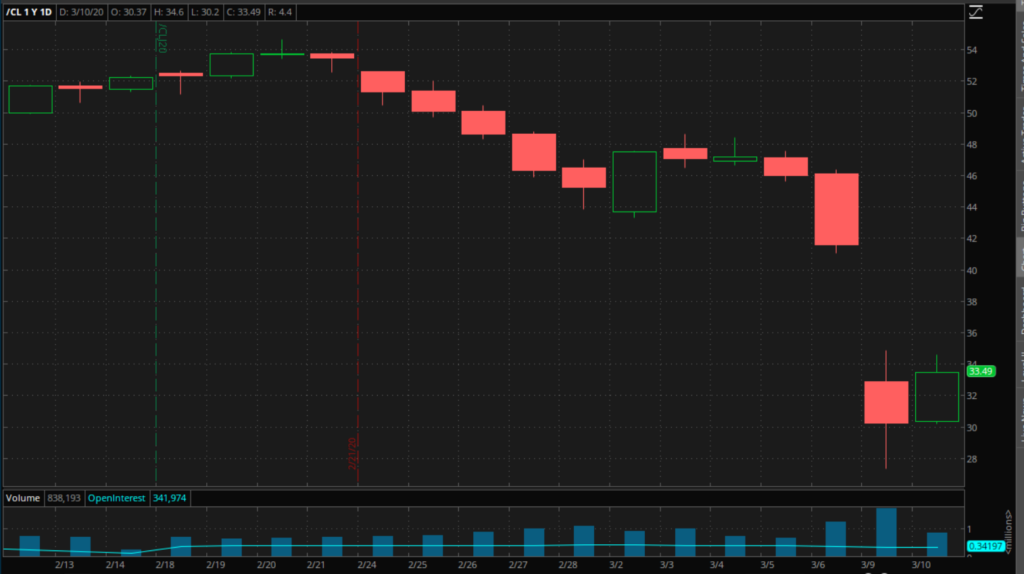

As a result of that announcement over the weekend, Monday saw the biggest one-day collapse in oil in decades. CL, the main WTI futures contract, dropped from Friday’s close of 41.57 to open the next trading day on Sunday night 8.69% lower, at 32.87. It then kept falling, hitting a low just below $28, a nearly 33% drop.

As you can see from the chart above, there was a bit of a bounce in Tuesday’s trading. That was particularly encouraging because oil preserved its gains as stocks flipped from a big up day to a small loss, but before we can assess whether that will have any legs, we have to first look at why the reaction was so drastic.

Why Did Crude Fall So Far, So Fast?

There are two main reasons. The first, that the news broke at a time when the market was already jittery and falling due to fears about the coronavirus, was unfortunate. The second, that the Saudi announcement came when the market was closed, ensuring the maximum possible impact, looks deliberate.

No big oil producer wants an oil price collapse, but amongst major producers, Saudi Arabia has some of the lowest lifting costs for crude, so they can withstand it better than most. It will hurt in the short term for sure, but it seems they deemed it short-term pain worth enduring for long-term gain.

The gain is in their power going forward.

What Next?

There are already rumors around that the Saudis and Russians will meet soon to reassess their decisions (hence the bounce) so their dramatic reaction and show of strength may be having an effect. Still, keep in mind that while those two countries are in dispute right now, their real, long-term dispute is with U.S. shale producers, not each other.

Those are the firms that stepped up their production to fill the gap left by the original output cuts, limiting their effect.

Given that, the most likely outcome of talks, if they happen at all, is something that will offer some short-term stabilization, but still keep the pressure on U.S. shale producers. That could come from the Saudis agreeing to gradually lift their prices or the Russians agreeing to a partial output cut, maybe even both.

Neither of those things, however, will cause oil to recover its losses in a hurry.

What to Avoid

That fact is being acknowledged by U.S. companies already. Several, most notably Occidental (OXY), have already announced massive cuts to planned capital expenditure and in some cases, including OXY, they have already slashed their dividend.

Occidental is particularly hard hit because of the state of their balance sheet. They took on a lot of debt when they purchased Anadarko last year, which creates huge problems. Their debt, like that of all oil companies is secured by their assets, which means by oil reserves. That collateral is now worth a lot less than it was a short time ago, so their leverage has in effect been increased.

They have no choice but to take immediate action in the hope that that will at least temporarily appease their creditors. One hopes it will be enough, but any rumblings from banks and bondholders, something that looks almost inevitable at this point, would quickly cause another major selloff.

A Stock Worth Long-Term Consideration

Occidental was among the first to make these moves but if, as I suspect, oil will not recover quickly and will start to trade in a new, lower range with a downside bias, they certainly won’t be the last.

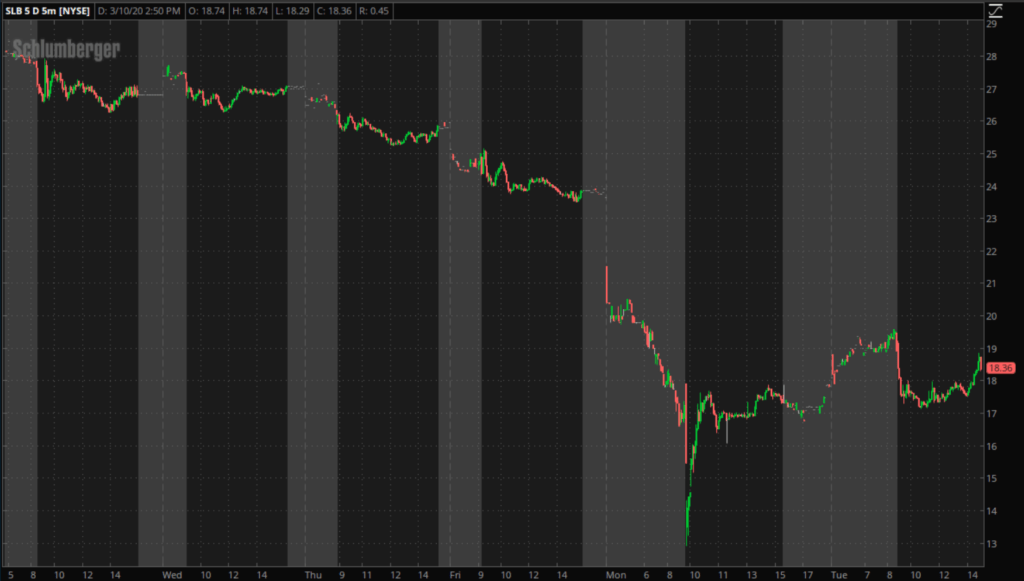

Probably the hardest hit stocks as they do that will be in oilfield services. That is why, as oil collapsed, Schlumberger stock (SLB) got hit even harder, losing nearly 50% of its market value within 24 hours at its low point.

That too has bounced since, but I trust this bounce even less that I do oil’s.

The fact is that firms like SLB will be hit hard even if oil stabilizes. The “new normal” of crude prices will still force E&P and integrated companies to cut capex, and each announcement will see SLB and other oilfield service companies take a hit. There is also the risk that they too will cut their dividend as a precautionary measure.

Short-term, then, it is one to steer clear of.

However, there will be a buying opportunity here before too long.

The thing is, while SLB, like all oil related companies, does also have a heavy debt load, they do have an advantage over a company like OXY. While Occidental went from profit to loss at the end of last year and has a negative free cash flow, Schlumberger has remained profitable and generates positive free cash.

That makes them much better placed to navigate through even an extended period of low oil prices.

Long-Term Considerations

At some point, oil will recover. The big capex cuts that we are seeing now in the U.S. and elsewhere won’t have an immediate effect, but before too long they will result in lower U.S. output.

I am not saying you should be buying now, but I would certainly keep an eye on the Baker Hughes rig count data, which can be found here. If that shows some consistent signs of shrinkage, buying something like SLB, particularly as a long-term play will be a decent trade.

Short-Term Strategy

For now, though, bounce or not over the next day or two, it will pay to wait before buying energy stocks and I would favor a “sell into rallies” approach when it comes to oil trades.

Incidentally, if you are someone that trades oil movements using any of the leveraged ETFs on the bull side, such as UWT or WTIU, exercise some caution. The massive drop in oil over the weekend has brought them to a level where closure of the funds is a real possibility.

Wisdom Tree has already closed their similar funds leveraging both WTI and Brent in Europe. It wouldn’t take much of a push lower for the same thing to happen to the U.S. listed funds.

Handling Volatility

You don’t need me to tell you that this is a crazy time in markets in general, but particularly in energy.

However, I worked in dealing rooms long enough to be familiar with even extreme volatility, and there are some lessons learned there that I can pass on.

First, don’t dwell on mistakes already made. They are history. Focus on what you will do next.

Second, whatever you decide to do next, don’t rush it. There is always a sense of FOMO (Fear of Missing Out) when markets are flying around but most moves are exaggerated so there is usually money to be made even if you wait for confirmation of a move before jumping in.

Third, keep initial positions small. That will allow you to set stops at realistic distances for volatile markets without getting killed when you get one wrong. On the other hand, when a trade is working, look for a level to add to the existing position and tighten the stop. That way you can still maximize profit potential.

For a more general look at handling volatility, I encourage you to read what I wrote on the subject here.

Cheers,

M