It’s Convention Season!

The Democratic convention will close tonight after four days of online presentations and speechmaking when Joe Biden gives his official acceptance speech of his party’s nomination for President. Then, as soon as Monday, the Republican convention, also a virtual affair this year, will begin. That too will end with an acceptance speech on Thursday, this time from Donald Trump.

This will mark end of convention season, which itself marks the beginning of the campaigns in earnest with televised debates and a flood of TV ads to look forward to.

How Should Investors React?

All this raises the question of how investors should react as politics dominates the airwaves. The answer is simple. They shouldn’t react at all.

We live in a time and place where polarized politics interfere with and often seem to define just about everything. People all too often consume media that confirms their biases, whichever side of the political divide they occupy. That results not just in two different sets of opinions, but in people believing in two different sets of “facts”.

If you doubt me, try flipping between say Fox News and MSNBC immediately following Biden’s speech tonight. On one channel you will hear that he is beholden to the radical left and is planning to march America down the path of socialism. On the other, you will hear that he is a moderate, intent only on bringing back sanity and decency, and on helping all Americans. Both sides will have heard the same words, but their “facts” about what was said will be completely different.

From an investing perspective, none of this matters unless you allow it to influence your decision making. Facts about companies aren’t, or shouldn’t be, subject to political spin. A corporation either makes money or it doesn’t. It is either growing revenue or it isn’t. It has potential or it doesn’t.

Call me old-fashioned, but I put my money where I think it will make the best return. The political affiliations of the CEO don’t influence that decision, nor does whether one side or the other typically like or dislike the industry concerned.

Biased Investing Doesn’t Work

The response of many people to the last two Presidents shows clearly that making investment decisions based on political bias is foolish.

Those that sold because Barack Obama was President, and they believed that he was going to run the economy into the ground, missed out on a period when the S&P 500 just about tripled. Similarly, those that believed that Donald Trump’s election in 2016 marked the beginning of the end of civilization and sold their stocks have spent the last four years waiting for a collapse, even as the markets have powered ever higher.

In reality, the U.S. economy does its own thing, regardless of who is in the White House. Politicians don’t have as much influence as most people, and definitely they themselves, think.

Democrats will claim credit for engineering a recovery from what they see as George W. Bush’s recession, while Republicans hail Trump because the market has continued on to all-time highs. In reality though, recoveries from credit crises are typically long, patchy, and slower than from other recessions. The last eleven and a half years have been pretty typical.

The Impact of Politics on Energy

As I said earlier, partisanship invades every part of modern life, often in ways that make no sense. Energy is no exception.

It is all wrapped up in the issue of climate change. Democrats will tell you it is the biggest challenge facing mankind and that big oil has to be stopped before it destroys the world. Republicans argue that even if it exists it isn’t man-made, that those big oil companies provide literally millions of jobs, and that a healthy oil industry is vital to our national defense.

Basically though, the fundamental partisan difference is what you might expect even if climate change wasn’t an issue. Republicans favor big business, Democrats side with the smaller, disruptive parts of the sector.

It seems to me that everyone is partially right. The science shows that climate change is an issue, but it is a global one, and if you discourage oil and gas production here it will just move overseas, and those millions of jobs will go with it. Big oil is important to the U.S. in both economic and national security terms, but that doesn’t mean that competition to them should be stifled.

Encourage the small guys, leave the big guys alone, and let the market do its thing.

Again, to bring this back to investing, if you allow your politics to dissuade you from investing in fossil fuel companies or alternative energy companies you will simply miss out on a ton of opportunities.

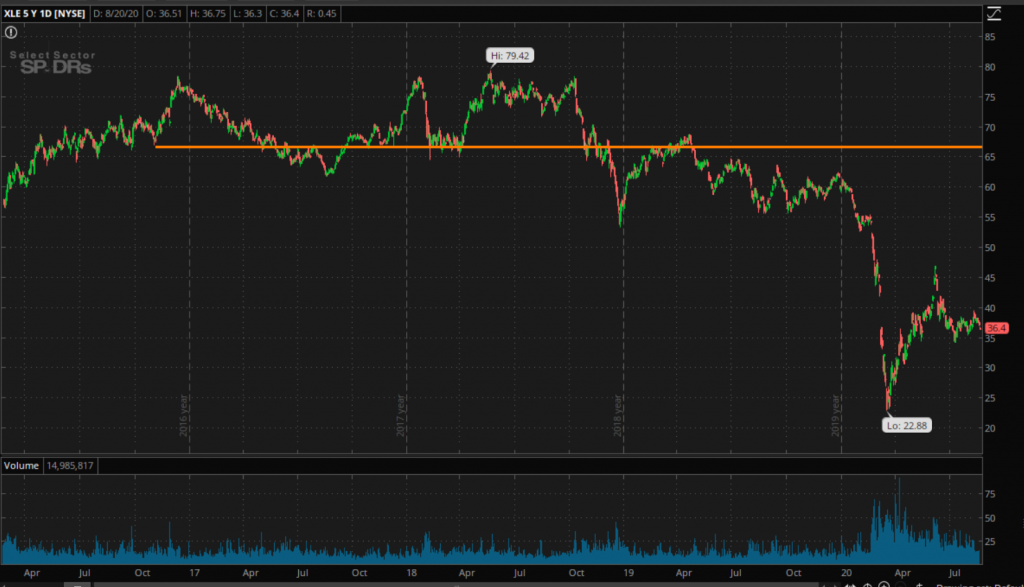

Nor should you buy too much into the hype about what one President can do to help or hurt certain companies. Remember, Trump’s election was going to be a big boost to the energy sector, but the sector ETF, XLE, has spent more time below where it was on the eve of his election since then than it has above that level. Buying it then and holding until now would have lost you close to 50%…

So, What Should You Do?

I said earlier that investors should not react to politics as the election heats up, but there are some exceptions to that. What you can do is take advantage of the political bias of others.

For example, if Joe Biden maintains his lead in the polls as the election draws near, the market will probably pull back somewhat. The popular narrative after all is that Republicans are “business-friendly” and Democrats are “anti-business”. There may be some truth to that in terms of what they say, but it doesn’t always translate to what they do, or certainly to how markets perform when they are in office.

In reality, the data shows that markets have performed better with Democrats occupying the White House over the last 50 years than with Republican Presidents.

There are a number of possible reasons for that. One is that the numbers are skewed by disastrous performance under George W. Bush, whose terms included both the dotcom bust in 2000 and the blowup in 2008. The other is that stocks tend to fall towards the end of Republican terms as Wall Street, which is presumably dominated by Republican-leaning billionaires and millionaires, begins to fear a switch to a Democratic administration.

Those fears, however, have always proven to be unfounded, so buying on that dip should it come this year is a solid, proven, long-term strategy.

That could also apply on a smaller scale. If Biden’s lead persists or widens, traditional energy stocks will probably fall. That happened on a relative basis after Obama won, but the shale boom negated any policy decisions, and more wells were started in the U.S. under him than under any other President.

There is no guarantee that energy will bounce if it does fall as the election approaches, but if at least some of that is down to fear of Biden, those stocks will be undervalued.

Conclusions

The basic message here though is to ignore the politics as best you can. It will no doubt be hard as our social media feeds and the airwaves become saturated, but from an investment perspective, stick to looking for stocks that are favored by both fundamental factors and technical setups, and you will be just fine.

Cheers,