General Rules for Crazy Markets

When a bunch of publishers, other market experts and I got together to start Deep Earth Publishing it was in response to what we saw as an opportunity for volatility, and therefore potential profit, in the energy sector.

Little did we know that we would be starting at the beginning of a record setting collapse in both the stock market and oil.

That has completely, if temporarily, changed how I see my role here. At this point, the most useful thing I can do is not to look for undervalued stocks to buy. Even the cheapest stock still has downside when this level of panic prevails. Nor is it to offer ideas for day trading oil markets that, in a market that moves this quickly, will most likely be closed trades by the time you read them.

There will be plenty of time for those things when things have calmed down and, as far off as that time feels right now, they certainly will.

Until that time comes though, the most useful thing I can do is to use my decades of market experience to guide you through the craziness.

When you hear on T.V. that this is the worst whatever since whenever, I probably lived and traded through that whatever whenever, and I’m still here.

That doesn’t make me infallible, but it does grant me some perspective. It makes me able to step back and look at the big picture; at the techniques and strategies that have enabled that survival, and at the lessons I learned along the way, then pass them on to you.

You Have More Time Than You Think

Whether from a trading or investing perspective, fear is your biggest enemy during chaos, but that isn’t just fear of further declines. Far more potentially damaging is the fear of missing out (FOMO) that grips people on the up days.

Markets never really move in one direction for long. At some point, even the most dramatic moves are interrupted by retracements. The majority of those, however, are temporary and after a brief respite, the move resumes.

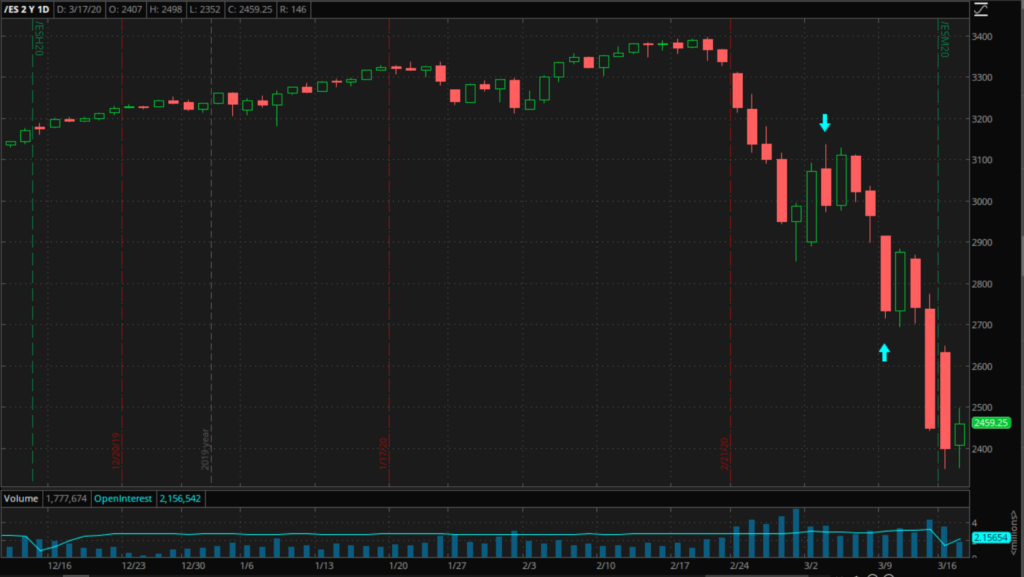

This move down in the stock market probably feels like a continuous collapse on the down days, but, as you can see from the chart for S&P 500 futures above, there have been two reversals in the last three weeks. Neither of them, however, marked the bottom.

When you are looking for entry points on a big drop, whether intraday or long-term, patience is a virtue. Understand that you probably won’t find the exact bottom, but too many failed attempts at doing so will ensure minimal overall benefit when you do.

It is far better to wait until there is some pre-set sign of a reversal before jumping in. Even that won’t guard against the occasional bad decision, but it will reduce the number of mistakes. And less mistakes skews the risk/reward ratio in your favor. If you miss out on a few percentage points of potential gains by doing so, so what? There will still be plenty of upside in a rebound after a collapse like this.

So, if you are being patient and waiting for pre-set signs, what are they?

What to Look for

There are a couple of things that I would look for as possible signs of a real, potentially long-lasting turnaround after a big move down.

The first would be a sustained bounce.

By that I don’t mean one up day as large in point and percentage terms as the down days. That may be upward volatility, but it is still volatility. That points to a lack of liquidity, which in turn means that the downside risk is still elevated.

If, on the other hand, we were to get three consecutive days of solid, decreasing gains, that would be a positive sign. It would indicate that while there were still sellers around, the buyers were winning a longer-term battle and starting an upward grind. In addition, the decreasing gains would suggest increasing liquidity, providing some protection against another sharp drop.

The second sign would be a real bottom formation. Again, that doesn’t mean a big one-day bounce off of a level. It means that a level which has held previously holds again, or preferably holds twice more.

The logic here is that a one-off bounce can be caused by a lot of things. It could be a news headline say, or, given the lack of liquidity, a big fund or two rebalancing their portfolios. If, however, that same level holds again, it demonstrates a collective desire to buy there, and that is the very definition of a support level.

Once you have identified a level, what next?

Don’t Go “All In” Immediately

Whether long-term investing or short-term trading, and whether the market is calm or crazy, it is always important to remember the one thing that every trader learns, usually very quickly. In a market, you can do everything right and still be wrong.

That is especially true here, where we passed the logical endpoint of this drop a while ago.

As one hedge fund manager pointed out on CNBC this week, if the U.S. GDP were to fall by 10% in the second quarter, way over what most people believe is likely, the economy will lose around $500 billion. By comparison, since the February highs, stocks have shed $10 trillion in market cap.

That has led to analysts at Bank of America, for example, saying that this may be the “best time ever” to buy discounted stocks.

That is some overshoot!

That doesn’t mean, however, that you should be rushing in to buy with everything you’ve got. If anything, it means the exact opposite.

It points to the fact that in a panicked, fear-driven move, logic is as good as irrelevant, and when the market is illogical you can easily make the wrong decision for all the right reasons.

That is why deploying any available cash in stages makes sense in an oversold market.

If, after you do that, the market continues on down, great! You can buy more even cheaper! If it goes up, great! You bought something at or very near the absolute bottom!

Don’t Panic!

Fans of “The Hitchhiker’s Guide to the Galaxy” will know that the words “Don’t Panic” were on the front cover of the guide, printed in “…large, friendly letters…”. Whatever the font, “don’t panic” is good advice for traders and investors as well as intergalactic travelers.

As already mentioned, that panic can take the form of FOMO, but it can also be panic as the market keeps falling that can provoke either paralysis or overreaction. Of the two I would take paralysis every time.

The worst thing investors can do at times like this is to do what so many individual investors before them have done; get squeezed to the point where you puke up all your hard-earned retirement savings at or near the bottom.

If you sold a significant amount near the top, either by luck or judgement, well done, but most people won’t have done that, and for them sticking it out and deploying any available cash at some point is the best option. That can only be done if you don’t panic.

I know that is easier said than done but being aware of the potential for panic on a big down day is at least half the battle. If you think about it in advance, you are far less likely to succumb to it when it starts to well up. Familiar enemies are far less scary.

I am inclined to believe that with all the bad news looking priced into both stocks and oil, we are closer to the end of this thing than the beginning. But, as there is still plenty of space for recovery, I am not in a hurry to buy. I am actively looking for signs of a real reversal but haven’t seen one yet.

When I do, I will assess it calmly and deploy some of my available cash.

That doesn’t mean that I will buy at the absolute bottom, nor does it mean that my timing will be perfect. What it will do, however, is tilt the chances of success in my favor, and forty years of market experience has taught me that that is the long-term key to surviving and thriving in crazy markets.

Good luck and keep washing your hands!

Cheers,

M