As you probably know, I worked in dealing rooms around the world for a couple of decades and when I left left that career, it was of my own volition after suffering a family loss in the 9/11 attack on the World Trade Center. That is a long time to earn a living in the trading world, and a large part of my ability to do that and control my own destiny was based on the fact that I am someone who stays quite calm when things go against me. That is part nature and part nurture. I am that way to some extent in other parts of my life, but it has become exaggerated in trading as the result of being taught that it is necessary if you are to survive in a job where failure is an everyday occurrence.

I don’t care how good you are, or think you are at analyzing data and reading charts; the fact is that a percentage of the trades you take will go against you. How you handle that, both in the short- and long-terms, will ultimately decide whether you succeed or fail as a trader. In the short-term, if you deny failure and refuse to cut at a reasonable and logical level, you risk blowing up your account completely with one bad trade. In the long-term, if you allow a failure to dominate your mindset, you will be trading scared and, as any poker player will tell you, scared money is dead money.

These aren’t new thoughts for me, but they came to mind over the last couple of weeks of trading in my Energy Income Trader service.

As you may recall, two weeks ago I made the somewhat bold call here in the Deep Earth Publishing newsletter that crude was going to $100 before too long. That analysis became an actionable trade in EIT, with a recommendation to take a long position in crude at around $62.50, either in futures or a commodity ETF, with a view to holding it for longer than most trades. It was still a trade, so I wasn’t looking for $100, but I was looking for a move up to around $68-69, a big and potentially very profitable move in futures.

Because of that proposed long hold time and distant target I set the original stop quite a long way away, at around $60. However, when WTI popped the next day, I decided to move the stop up to just below $62. With hindsight, although that is something I have done hundreds of times and that has often resulted in a lot less money lost than if I had done nothing, it was a mistake. Crude dropped to a low of $61.56 that night and hit my adjusted stop, before bouncing and starting the strong run up to close to $70 that we are seeing now.

Ouch!

Even though I did the wrong thing for the right reasons, that is something that can throw you off your game for a while. Indeed, I did waste a few hours in self-doubt, asking myself the question “Why did I do that?”, even though I knew that I did it because over time it is the right move to adjust a stop upwards on an initial gain and that, no matter what, there was nothing I could do about it at that point. Then my training kicked in and I asked the much more pertinent and useful question…” Would I do things differently the next time?”. The only answer to that is no, for the reasons given above, so I moved on to the next trade.

I am glad I did. That idea was to buy STEM, an energy storage company that went public via SPAC a while back and had dropped back after a surge immediately following the merger. That trade hits its initial target yesterday, ensuring a nice profit for anyone who followed along. If I were still dwelling on the past mistake, I would probably have been tempted to take the safe route there and bank a profit early before hitting the target level yesterday. However, having moved on, I elected not to. Also, when we hit the $3 target, I didn’t just cut out, but chose to sell only half the position, tighten the stop on the remaining half, and see if the upward momentum in the stock continued. So far, with STEM up over 2.5% again today, that looks smart. A defensive, scared me who was dwelling on a previous “mistake” wouldn’t do that.

Then there was the other open trade…

Subscribers to Energy Income Trader don’t just get the newsletters and trade ideas, they also get three special reports for free. One of those reports is my best energy trade idea at the time you subscribe, and for a couple of months now, that has remained the same…to accumulate stock of Transocean (RIG) between $3 and $3.50.

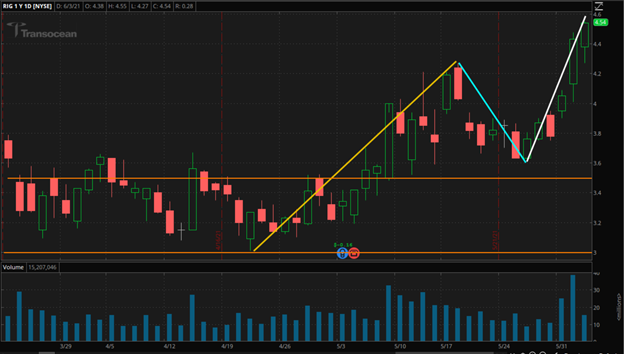

As you can see, that worked out well. There were plenty of opportunities to buy RIG at around the desired $3.20 average before a surge up to above $4.20 in the first half of May (yellow trend line). Shortly after my failed WTI trade, though, RIG fell quite sharply to around $3.60 (blue trend line).

If I were dwelling on the one bad trade instead of the good, I would probably have got out at that point and sent out a trade alert, recommending taking a small profit before all the money was given up on a fall back through the $3.50 level. As it was, though, I resisted that temptation, and subscribers who took the trade are now looking at a profit of over 40% with a good chance of more to come.

The lessons here are obvious. Trading involves occasional, or sometimes frequent, losses. That is unavoidable. But when things go wrong, it doesn’t mean that you are doing things wrong, or that well thought out, rational strategies should be abandoned, or that opportunities should be ignored because you might get something wrong again. If you remember that you will be a better, more profitable trader.

Of course, there is one other extremely important lesson here, too. If you aren’t subscribing to Energy Income Trader, you are missing out on some great trades in what is currently an outperforming sector of the market, so click on one of the above links or click here to sign up!

Cheers,

M