|

I make it a habit to, at the beginning of each quarter, take a step back and reassess my base case for the market that I follow most closely, crude oil. I do that in a “top down” style, meaning that I start with the big influences, global growth, currency moves, and the like, then narrow down to U.S. conditions that will potentially have an impact. At the end of it all, I usually have an idea as to where I think the bias will be in those markets in the coming months.

So, as Q4 begins, let’s do just that…

Global Growth

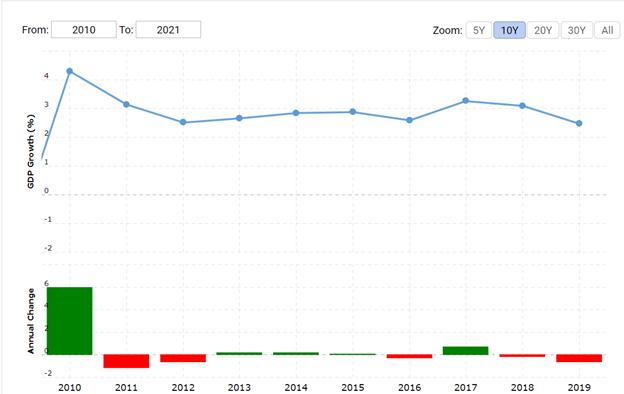

According to the OECD, global GDP declined by an “unprecedented” 9.8 percent in Q2 2020. Of course, we all know what caused that… the worldwide shutdowns to contain the spread of Covid-19. Even before that though, growth in global GDP was slowing…

That isn’t really anything to worry about because growth was still positive, but it does suggest that the expansion that followed the 2008/9 recession was naturally slowing down.

The question is whether that sluggish growth before the shock will make a rapid bounce back more difficult than it would otherwise have been. In theory, it shouldn’t do. If anything, a sudden drop like that sometimes clears out some dead wood, enabling economies to bounce back stronger than before. In practice, however, there is another factor at play here.

As economies have reopened throughout the developed world, there has been a resurgence of Covid cases. At some point that will be rendered moot by an effective, freely available vaccine and/or therapy, but the longer we go without that, the more likely it is that rather than continuing to recover, some economies will take a step back.

The stock market, that can look forward indefinitely, can basically ignore those potential short-term problems, as it has been doing. Front-end WTI futures, however, which have a finite lifespan by definition, cannot. That is why, as the stock market climbed to new highs on things like vaccine hopes and unemployment of “only” around 8% in America, crude never got even close to its pre-crisis levels.

Based on the above, betting on a rapid bounce back in global demand looks risky and doing it through the oil market even more so.

The Dollar

After spiking as the world shut down in a flight to safety, the dollar index (DXY) dropped back quite rapidly and has been fairly stable for a while.

That is what you might expect and doesn’t really tell us much. However, as oil is priced in dollars, a continuation of the very recent downward trend could put upward pressure on crude in the short term.

The U.S. Economy

Unlike global growth, the U.S. economy went into the coronavirus crisis in a position of strength, with low unemployment, decent growth and low inflation. That should mean that it can bounce back quicker than most, and to this point that has been the case.

Unemployment has been falling again, and consumer spending has recovered quickly. However, don’t believe what the stock market seems to be saying.

The S&P 500 hit an all-time high at the beginning of September, and even after a pullback isn’t too far off that now. That might suggest that economic conditions are back to where they were in the first month or so of the year, but they are not. The stock market is not the economy.

Unemployment has fallen, but is still over 8%, an extremely high level, and the last two weekly reports have seen new jobless claims of over 800k. That is better than it was and hints at better times ahead, but it is still the stuff of deep recession, not booming recovery.

The stock market however, as I said above, looks much further forward than commodities markets, so it hitting highs is understandable.

U.S. Supply

As the price of crude fell rapidly when the world’s economies shut down in February and March, so U.S. output fell precipitously with it. Over the last couple of months, however, the production declines have slowed just about to a stop as the reduced demand and domestic supply have come back into balance.

That doesn’t look likely to change any time soon.

A lot of smaller firms responsible for marginal U.S. production have gone under, but the reserves and production capacity still exist. If prices rise enough to warrant increased output, therefore, that will come, but maybe with enough of a delay to put a short-term squeeze on prices.

The biggest factor in the chances for increased oi supply in America is probably the upcoming election. Should Donald Trump, who has consistently shown himself to favor big oil, win, then more deregulation and encouragement to “drill, baby, drill” would see a potentially big increase in output capacity.

On the other hand, a Biden win, resulting in a policy bias away from oil and towards alternatives and increased regulation, would probably depress capacity.

That doesn’t mean, though, that a Biden win would be bad for oil. Assuming economic conditions remain relatively stable, that supply and capacity reduction will kick in quickly, whereas changing consumer and business behavior, and therefore the demand for oil, will take time. That disconnect would, for a short time at least, make for oil upwards.

Conclusions

As it sits, the long-term, fundamental influences on the price of crude look pretty balanced. Weak global growth and tepid economic conditions aren’t encouraging to bulls, but Adam Smith’s “invisible hand” has done its job and supply has adjusted to compensate for that.

Where we go from here depends on what happens next, but given that there looks to be a high risk of more economic weakness as Covid-19 resurges and given the more immediate nature of that risk than any supply issues, I will start Q4 trading with a bearish bias.

Cheers,