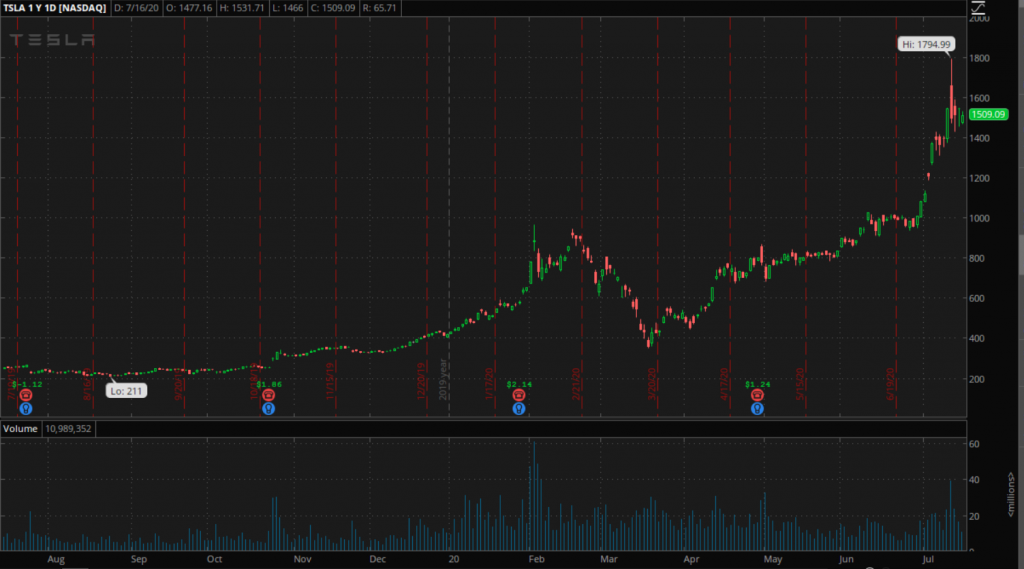

If you follow markets, you will already know that Electric Vehicle (EV) stocks are hot right now. The big daddy in the field, Tesla (TSLA), is off a bit from its high of 1794.99 earlier this week, but even so is up around 330% in the last four months!

That looks a bit excessive, but at least Tesla has viable, well-liked vehicles on the market and has, over the last three quarters, shown that it can actually make money. That is more than can be said for the other two EV stocks showing spectacular gains. Both Nio (NIO) and Nikola (NKLA) are losing money, but that hasn’t stopped their stocks making high triple digit percentage gains in recent moves.

That kind of movement sure grabs my attention, and I want to profit off it somehow, but I have a problem at these levels.

Call me old fashioned if you like, but I remember 2000 and the dotcom bust all too well, so massively overpriced, highly speculative stocks have limited appeal to me. I mean, Nikola is not even anticipating making a truck until 2022, but the company is valued at over $19 billion. On the other hand, though, I am not about to short these things either on the basis that standing in front of a runaway express train because you think it will stop at some point is rarely a good idea.

So, as I am not prepared to either buy or sell EV stocks at these levels, I started to look for another angle.

These incredible bull runs may be a bit bubbly, but they are being driven by something quite fundamental and very real. EVs are gaining in popularity and will continue to do so for some time, until they completely dominate the auto industry. The world is moving away from fossil fuels, and other possible “green” car powering technologies such as hydrogen cells may have a place eventually, they have been left in the dust as Elon Musk has shown that EVs can be more than just “green” … they can be sexy too.

The shift is undeniable, but even if you ignore the current unrealistic valuations, there is still a problem with trying to pick a winner amongst manufacturers. There is no guarantee that what is a market leader or is the trendy thing right now will still be once the technology is fully developed. It is all too easy to find yourself investing in an “Ask Jeeves” or “Myspace” rather than a Google or Facebook. Another dominant firm could emerge, or one of the big boys in auto manufacturing, a Ford, say, or BMW, could start taking EVs seriously and begin to dominate.

Whoever wins, though, one thing is clear at this point… battery powered car production is going to increase rapidly. That means that demand for the Lithium used in the batteries that power those vehicles will be increasing too.

That is the kind of “picks and shovels” approach that I like for long-term investing in the early stages of societal trends like this.

That phrase comes from the fact that even though a tiny percentage of prospectors during gold rushes actually struck gold, the companies that sold them picks and shovels made money off of all of them. Similarly, it is reasonable to expect that as demand for lithium explodes, the lithium miners will be big beneficiaries, whoever ends up as the king of EVs.

You might think that in a market that seems to be all about what will happen rather than what is happening (The S&P 500 is now higher than a year ago, even though earnings are already pointing to a big drop from last year, for example) that would be reflected in Lithium stocks, but you would be wrong. They have been under a lot of pressure, and for good reason.

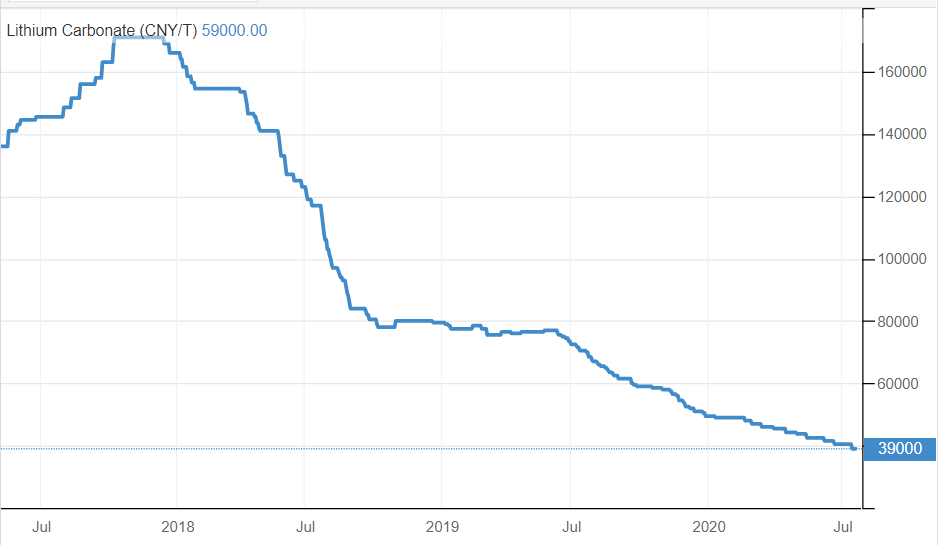

The story above is well-known, and has been for years, which led to a boom in Lithium mining. The problem was that that supply boom came before any real boom in demand. Lithium prices have, as a result, done this since the end of 2017…

In that context, the performance of stocks in the sector, despite the obvious potential, makes perfect sense. The only U.S. pure Lithium mining play stock, Livent Corp. (LTHM), for example, has done this over the last 5 months…

Others have done somewhat better. Albermarle (ALB), for example, who derive only around half their revenue from Lithium but are one of the biggest producers, have seen their stock bounce with the EV companies, regain most of the losses from February and March, and get to a 1 year gain.

Even in those cases, though, there seems to be a disconnect between the market’s extreme bullishness on EV manufacturers and the relatively weak performance of the suppliers of their most essential raw material. That will change as production catches up with promise. Right now, with extreme valuations on TSLA, NIO, and NKLA increasing the likelihood that investors look around for another way to play EVs, adding one or more Lithium miner to your portfolio if you haven’t already done so looks like a smart move.

Cheers,