A Tale of Two Timescales

It seems like an age ago, but it is actually only a couple of weeks since WTI futures had their historic moment of madness, with the expiring contract hitting a price of negative $30 per barrel. At that time, I pointed out that that was a short-term phenomenon. It was a perfect storm of high supply, gutted demand and a shortage of storage space. I also said, a couple of days later in the April 23rd newsletter that…

“If, as looks likely, demand is recovering quickly at the same time as supply is dropping dramatically, the spike, like the crash, could be of epic proportions.”

To be honest though, I didn’t expect that to have happened two weeks later!

Crude’s Strong Rally

From the April 20th low of $6.5 to its high early this morning, the main WTI futures contract jumped by just over 300% in eleven trading days. I guess that qualifies as a spike of epic proportions, even if oil prices are still low as compared to the average over recent years.

The question for traders and investors though is whether or not that rally is sustainable. The answer, as is always the case in commodity markets, depends on your timespan.

Is It Sustainable?

My prediction of a spike was based on the fact that the price collapse would necessitate production cuts in the U.S. and that they would probably be felt just as demand began to recover. In a limited way, that is what we have seen over the last couple of weeks, but the fundamental issue that caused such chaos in the expiring contract hasn’t completely gone away.

Supply has certainly been reduced, but the EIA numbers released last week showed crude stocks in the U.S. to be at 532.2 million barrels versus 518.6 million two weeks before, with stocks at Cushing, where the biggest problem was, having risen from 59.7 million barrels to 65.4 million.

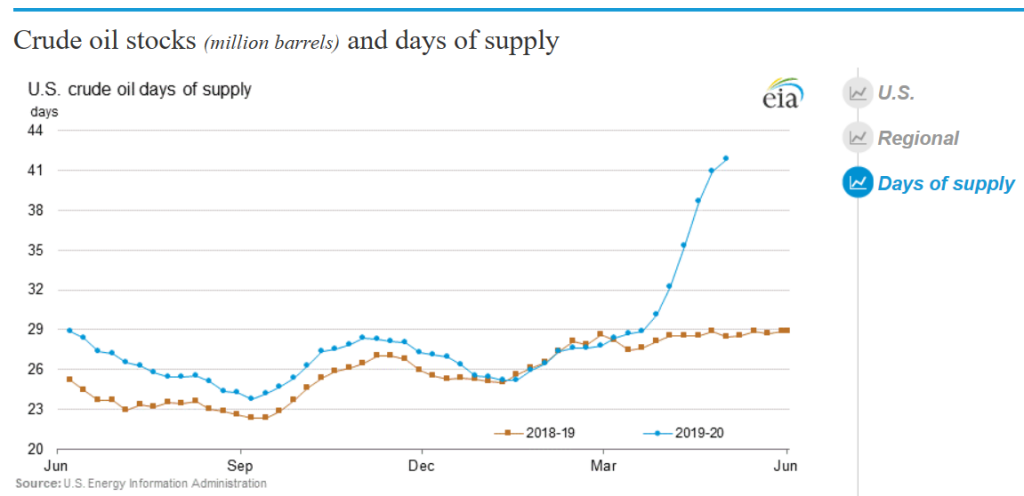

There is hope on the demand side, but so far it is only that…hope. That is why, as of now, the EIA chart showing days of supply in the U.S. as compared to last year looks like this…

Still, things are improving a bit. Some states are easing restrictions with most others planning to do so soon. Logically, as we creep back towards “normality”, whatever that will look like in a post-pandemic world, gasoline and therefore oil demand will increase. What we don’t know yet, though, is how smooth that path back will be. If coronavirus cases spike considerably in states that have opened up, we will be back to square one from a demand standpoint.

I hope and pray that doesn’t happen, but it just looks as if the market is ignoring even the possibility of a setback.

Short-Term Outlook

Let’s assume that doesn’t come though and demand does continue its gradual rise. Even then, as this most recent front-end contract nears expiration, there will be a storage space issue. It may not be as bad as last time, but I certainly don’t want to bet on crude continuing to rally over the next couple of weeks as that time approaches.

So, after riding the wave of the rally, in the short-term, which in this case means over the next couple of weeks, I will be switching to a short bias in crude.

And the Long-Term…

What happens after that depends on the public health effects of reopening in states where that has taken place. The most likely scenario is that there is no major setback and demand continues to increase, even as the effects of record numbers of wells being shuttered continue to result in further declining supply.

At that point we could be really off to the races.

How to Play It

As I said, a short bias if you are trading crude futures over the next couple of weeks looks like the best point from which to start. That doesn’t necessarily mean go out and sell some contracts right now of course, but rather look for intraday upward moves petering out as opportunities to sell and be wary of joining upward momentum trades.

If you are more of a longer-term investor or swing trader, then exercise some patience. There are likely to be better entry points before too long than we are currently seeing. At some point, though, we will recover, and when we do, there will be a lot of upside. In the meantime, any weakness will still be a buying opportunity for high-quality energy stocks with strong balance sheets.

There is one other trade that is worth considering if you are a futures trader.

You could initiate a calendar spread by selling the short-dated contract, while simultaneously buying a longer-dated one. That is normally not a smart move, as the two prices naturally converge as one contract expires, but in this case, as happened last month, the spread could easily widen.

The outlook for crude, then, is a tale of two timescales.

The rally makes sense in the context of the long-term outlook, but the same storage issues that were such a problem before are likely to resurface. Once again, that will be an anomaly caused by the nature of deliverable forwards, but it is hard to see how it won’t have an effect. At minimum it should limit the upside for a while.

Once that is out of the way though, we will be back in an environment of declining supply and rising demand, and you don’t need me to tell you what that means for price!

Cheers,